Bitcoin 2140: The Protocol and the Paradigm

The final satoshi won’t be mined for over a century, but the decisions we make today will decide whether Bitcoin —and its attached ideology—survives long after issuance ends.

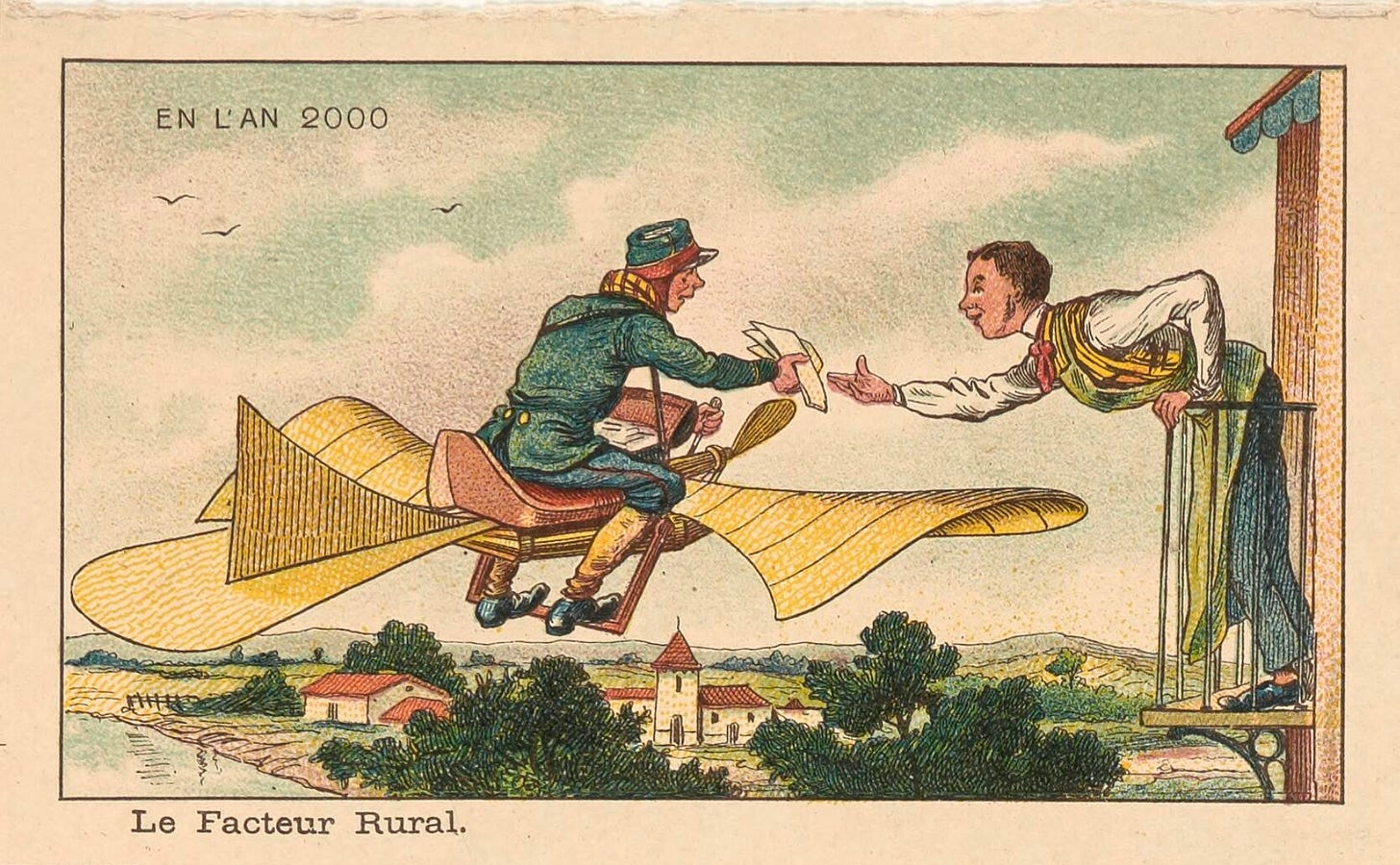

This whimsical illustration from the “En L'An 2000” series imagines the future of rural mail delivery, as envisioned by French artist Jean-Marc Côté in 1899. Originally created for cigar box inserts and postcards, it captures a turn-of-the-century imagination projecting into the year 2000—long before the internet, email, or drones were even conceivable.

I’m sharing it as a reminder that futures are always built in the minds of the present. This is my attempt to do the same: to think into a future I’d like to help shape, while analyzing the forces—technological, economic, and cultural—that will carry us to the last Bitcoin mint and beyond.

I know—it may feel presumptuous to write about a century into the future. But I don’t see it as prediction. I call it living in the longer now—the act of stretching our temporal lens to evaluate the present with more depth, nuance, and patience.

After all, transformative systems take time.

It took over 100 years from the American Revolution (1776) to the creation of the Federal Reserve in 1913, which finally formalized the U.S. monetary infrastructure.

And with technology: while ARPANET, the first packet-switched network, emerged in 1969, it wasn’t until the late 1990s that the internet became truly mainstream—over three decades of infrastructure, experimentation, and cultural shift. And then it took another decade for it to become deeply embedded in everyday life. Today, few can imagine their lives without it.

So when we talk about Bitcoin’s timeline, it’s not about price action or halving cycles. It’s about whether we’re laying the right foundation of code, culture, and conviction today for a system that may not fully bloom until 2140.

This longer now framing helps explain not only how Bitcoin works—its default settings, its incentives, and its adoption curve—but also reveals the deeper blueprint of decentralized thinking it introduces to the world. A blueprint that urges us to reimagine social contracts, rethink cooperation mechanisms, and question the very systems we take for granted simply because we were born into them.

Because the longer now isn’t about waiting.

It’s about building with eyes wide open.

Now that BTC is at an all-time high and you're naturally thinking about your net worth, remember: this isn’t just about charts and gains. If you’re playing this game, you’re casting a vote—for freedom over control, for open systems over gatekeeping. You’re vouching for a new kind of global cooperation—one built not on coercion, but on code, consensus, and voluntary alignment.

And if we get it right, it won’t just change money. It’ll open the door to a new era where coordination is sovereign, and control is no longer centralized.

1. Intro: The Clock is Ticking to 2140

In 2140, you won’t be here. Neither will I (unless biohacking, CRISPR, and a heroic adaptogen regimen prove me wrong). But somewhere, deep in the Bitcoin ledger, the final satoshi will be quietly mined. That moment will mark the end of Bitcoin’s issuance era—no more block subsidies, no new coins entering circulation. Just the cold mechanics of math, incentives, and human behavior.

For some, this milestone sounds like a distant curiosity. Can a decentralized network survive with no new coins to mint—only fees to sustain it? Can Bitcoin remain secure, relevant, and widely used when its most powerful monetary lever—issuance—is turned off forever?

But here’s the twist: what happens in 2140 depends entirely on what we do and understand now.

Bitcoin was never meant to rely forever on new coin rewards. From day one, it was designed to phase out subsidies through a process known as halving—a predictable reduction in the amount of BTC created every four years. The long-term vision? That as adoption grew and demand solidified, users would voluntarily pay fees high enough to keep the network running.

That’s not just a hope. It’s a design bet.

And that bet means that the fee market we’re building today—the apps we onboard, the L2s built, the users we attract, the culture we cultivate—isn’t just about growth. It’s about preparing Bitcoin to stand on its own.

Because when the last satoshi is mined, Bitcoin won’t automatically keep working. It’ll keep working if we’ve built an economy, an ecosystem, and a story strong enough to carry it.

So what happens after the last mint?

Let’s break it down—starting with how Bitcoin actually works, why its security model is a bootstrapped marvel of incentive design, and what it will take to keep the network alive long after the final coin is mined.

2. Bitcoin’s Tokenomics: Scarcity, Subsidy, and the Incentive Engine

Bitcoin isn’t just software—it’s a monetary machine built on incentives. And at the heart of that machine lies one key assumption: people will act in their own economic self-interest.

The way Bitcoin gets people to behave in a way that secures the network—without a central authority—is through a simple but powerful equation: miners provide energy and computation in exchange for rewards. These rewards come in two parts:

Block subsidy – Newly minted BTC awarded to miners when they add a new block to the chain.

Transaction fees – Paid voluntarily by users to have their transaction included in a block. Think of it like a tip: the higher the fee, the faster your transaction is confirmed.

At the beginning, almost all of the reward came from the subsidy. In 2009, when Bitcoin launched, each block paid 50 BTC to the miner who successfully validated it. That subsidy is cut in half roughly every 4 years, in an event known as the halving:

2009: 50 BTC (back then 1BTC < $0.01)

2012: 25 BTC

2016: 12.5 BTC

2020: 6.25 BTC

2024: 3.125 BTC

2028: 1.5625 BTC

… until around 2140, when the block subsidy finally hits zero.

Each halving reduces the new supply of BTC entering the market, creating programmed scarcity. This mechanism is what gives Bitcoin its disinflationary nature. Let’s quickly break that down:

Inflationary = supply grows, often unpredictably (e.g., fiat currencies). This reduces purchasing power over time

Deflationary = total supply decreases over time (rare in practice). This means money becomes more scarce, and its purchasing power increases.

Disinflationary = supply still grows, but at a decreasing rate.

Bitcoin falls in this camp, tapering off until it hits a fixed cap of 21 million coins. That means inflation still exists, but it slows down predictably over time.

But here’s where it gets interesting: Bitcoin’s security budget—the total amount paid to miners for keeping the network safe—has always been front-loaded.

In other words, Satoshi designed the system to give generous rewards up front (when the network was weak and new) and taper off gradually over time (as adoption and transaction demand grow). As of mid-2025, about 93.6% of all bitcoins have already been mined (~19.65 million BTC). By 2036, over 99% will be in circulation. After that, issuance trickles down until it stops entirely around 2140.

So what happens when there’s no more subsidy?

That’s where transaction fees are supposed to take over. In Bitcoin’s long-term vision, as more people use the network, they’ll compete to get their transactions confirmed quickly—driving up fees. Those fees will then replace the block subsidy as the miner’s main incentive.

But there’s no guarantee this happens at the right scale or pace.

If users aren’t willing to pay enough to make mining profitable, the network could lose miners. Fewer miners = lower hash rate = less security. That opens the door to threats like:

Censorship by dominant miners or hostile state actors

51% attacks, where an attacker can rewrite transactions

Stagnation, where blocks become slower or less reliable

Scarcity isn’t just a design quirk—it’s the foundation of Bitcoin’s value proposition. But scarcity alone doesn’t secure a network.

In short: the health of Bitcoin’s future fee market isn’t a minor detail—it’s the whole game.

And that brings us to the next layer of the story: how Bitcoin bootstrapped its own security, and why the tradeoffs we accept today will echo for a century.

3. Bitcoin’s Bootstrapped Security Model

Bitcoin is often called “trustless”, but that’s not quite true. It doesn’t eliminate trust—it distributes it through incentives and verification. The system was designed to be self-reinforcing: the more valuable Bitcoin becomes, the more miners want to secure it, and the harder it is to attack.

When Bitcoin launched in 2009, it had zero market value. There were no institutional miners, no industrial farms—just a handful of cypherpunks running CPUs for fun. To incentivize participation, Satoshi front-loaded block rewards, paying 50 BTC per block at a time when Bitcoin was worth pennies (or less).

That subsidy was the bootstrap. It compensated early miners for the energy they spent securing a network no one trusted yet.

As Bitcoin grew, so did the arms race for mining hardware: CPUs → GPUs → ASICs (Application-Specific Integrated Circuit is a computer chip designed to do one thing extremely well. In the context of Bitcoin, an ASIC is a specialized mining device built solely to perform the SHA-256 hashing algorithm used in Bitcoin’s Proof-of-Work system.)

Mining became a capital-intensive business, and the hash rate soared—from less than 1 GH/s in 2009 to over 650 EH/s today. That’s an increase by a factor of 10^17.

On Hashrate

Bitcoin’s security depends not just on code, but on raw computing power. That power is measured in hashrate—the total number of calculations miners perform every second to try to solve the cryptographic puzzle that allows them to add a new block.

Think of it as the number of lottery tickets being scratched globally, every second, in hopes of winning the next block.

As of mid-2025, Bitcoin’s hashrate hovers around 650 exahashes per second—that’s over 650 quintillion guesses per second.

Higher hashrate = stronger security.

A high hashrate makes it exponentially harder for any one entity to rewrite history or execute a 51% attack.Lower hashrate = risk.

If miner rewards shrink too much, they may switch off. Less hashrate means a weaker network—both economically and defensively.

This is why miner incentives matter. If miners are underpaid, they leave. If they leave, Bitcoin becomes easier to attack. Hashrate is not just a technical metric—it’s the heartbeat of Bitcoin’s security layer.

The Miners of Today

Today, the Bitcoin network is secured by hundreds of thousands of ASIC machines operated worldwide, primarily aggregated into pools that coordinate work and share rewards. The top players dominate:

Foundry USA, AntPool, and ViaBTC collectively control over 65% of global hash power.

Geographical distribution of hashrate:

USA: ~38%

China: ~21%

Kazakhstan: ~13%

Canada: ~6.5%

Russia: ~4.7%

This geographic and organizational spread makes Bitcoin resilient—but also reveals points of centralization risk if any jurisdiction cracks down.

The Role of Full Nodes

Mining isn’t the whole story. Bitcoin’s consensus rules are enforced by nodes—computers running the Bitcoin Core software to verify transactions and blocks independently.

As of mid-2025:

There are ~20,000 publicly visible full nodes, plus thousands more operating privately.

They don’t get paid—but they’re essential. Nodes ensure that no miner, no matter how powerful, can unilaterally change Bitcoin’s rules.

Together, miners and nodes form Bitcoin’s dual immune system:

→ Hashrate protects against external attacks

→ Full nodes protect against internal corruption

The Security Tradeoff Ahead

Here’s the kicker: Bitcoin’s current security budget is dominated by block subsidies, not fees. Roughly 95% of miner revenue today still comes from the subsidy, which is shrinking with each halving.

That means Bitcoin is still living on training wheels—and those wheels are coming off.

The transition to a fee-driven economy isn’t optional; it’s inevitable. And whether Bitcoin survives that shift depends on three forces:

Economic incentives (Are fees high enough?)

Network usage (Is there enough demand for block space?)

Cultural relevance (Do people still care enough to pay for security?)

Next, we’ll zoom in on the fee economy—and then, on why Bitcoin’s cultural gravity might be as important as its hash rate.

4. Narrative as Consensus: Culture as Infrastructure

Bitcoin is often framed as software, money, or infrastructure. But it’s also something harder to quantify—and maybe more important in the long run: culture.

In a future where Bitcoin is no longer paying people to secure it with fresh coins, it must survive on demand. That means people must not only use Bitcoin—but care about it enough to keep it alive.

Belief → Demand → Fees → Security

Bitcoin’s future security doesn’t just depend on miners and code. It depends on belief.

If people believe Bitcoin matters, they’ll use it.

If they use it, they’ll pay for block space.

If they pay for block space, miners will keep mining.

If miners keep mining, the network stays secure.

That’s not ideology—it’s game theory. But game theory without culture is just math. And math alone doesn’t spark movements.

Bitcoin as Myth, Meme, and Movement

Bitcoin’s early appeal wasn’t just economic—it was emotional.

It emerged after the 2008 financial crisis, inscribed with a headline in its genesis block (“Chancellor on brink of second bailout for banks”). It attracted idealists, anarchists, hackers, misfits, and eventually hedge fund managers. It became a brand, a meme, a mythology.

That culture still matters:

HODL memes encouraged long-term thinking.

"Don’t trust, verify" became a mantra of self-sovereignty.

Bitcoin Twitter became a chaotic battleground of ideas.

Even the orange coin became a symbol—subtle, but powerful.

All of this creates narrative gravity—a reason people choose Bitcoin over a shiny new chain with faster features. In a post-subsidy world, that gravity becomes part of the security model.

Before moving on, let’s spotlight one of the most underappreciated dimensions of Bitcoin’s origin story: the creator(s) walked away. No press tour. No foundation. No centralized treasury. Just a whitepaper, some code, and a final forum post.

Satoshi’s disappearance meant no central authority, no single point of control, no one to follow or overthrow. The protocol was left to speak for itself—to evolve by consensus, not command.

The voiceless creator sparked a global echo.

In that silence, something extraordinary happened. Bitcoin became not just decentralized in code, but in culture. No face to worship. No founder to defend, blame or jail. Just an idea, passed peer to peer, block by block—shaped by anyone, owned by no one. There’s no centralized entity to license, audit, or restrict. You can’t force KYC on miners. You can’t call up Satoshi.

That absence created resilience.

That myth created meaning.

And that vacuum of power? It became a feature, not a flaw.

In a world obsessed with leaders, Bitcoin began with a ghost.

This teaches the world new ways to create systems.

Not just financial ones—but political, social, and digital systems that can outlive founders, resist capture, and be owned by everyone and no one at once.

Bitcoin as a Geopolitical Survival Tool

In collapsing economies, authoritarian regimes, and unstable regions, Bitcoin isn't just a speculative asset—it's a financial lifeline.

These aren’t edge cases—they're proofs of relevance.

When people are willing to pay high fees to transact in Bitcoin not for profit, but for freedom, the network becomes more than just a ledger. It becomes a neutral global utility, like the internet.

That geopolitical utility drives real demand—and that demand pays for security.

This is culture turned into cryptoeconomics.

Bitcoin is not compliant finance. It’s sovereign money.

Bitcoin isn't just a tech platform or a speculative asset—it’s a neutral monetary rail for people and nations who can’t trust domestic institutions. That makes it more than code. It makes it strategically relevant in a fragmented, high-stakes global financial landscape.

Where legacy systems rely on intermediaries, permissions, and politics, Bitcoin offers something radical: uncensorable finality. And in places where money is fragile, politicized, or weaponized, that finality is everything.

Here’s where Bitcoin’s non-speculative, high-fee use cases are already playing out and why they matter for its long-term survival:

🏦 Currency Competition in Failing Economies

In countries like Argentina, Turkey, and Lebanon, inflation isn't a theory—it’s a lived experience. Savings evaporate. Exchange rates fluctuate daily. In these environments, Bitcoin becomes more than digital gold—it’s a parallel monetary system. A pressure valve. A store of value outside collapsing regimes.

Users in these markets willingly pay transaction fees—not because Bitcoin is cheap, but because it’s more stable than the peso or the lira.

⚖️ Neutral Settlement Layer Between Adversaries

Bitcoin also functions as a stateless settlement layer. In a world of increasing geopolitical fragmentation—U.S. vs. China, Russia vs. the West—trustless money becomes a neutral zone.

Adversarial actors may not trust each other’s banks, currencies, or SWIFT access—but they might still trust Bitcoin’s math.

BTC becomes the settlement option of last resort. Slow? Maybe. But neutral. And sometimes, that’s more important than speed.

🪙 Digital Gold for the Politically Unbanked

Where the rule of law is weak, or where capital controls restrict access to global markets, Bitcoin plays a new role: digital gold you can actually move.

Whether you're an individual fleeing a collapsing regime or a small business operating in legal gray zones, Bitcoin becomes a tool for mobility, liquidity, and discretion.

You can’t walk across a border with bars of gold or a Swiss bank account. But you can carry twelve words in your head.

🕊️ Financial Sovereignty for Activists and NGOs

From protesters in Nigeria to journalists in Belarus, Bitcoin is used as censorship-resistant money. NGOs facing frozen bank accounts, surveillance, or deplatforming use BTC to receive and distribute funds safely.

In these cases, fees aren’t friction—they’re a small price for sovereignty.

🔐 Off-Ramp Resistance in a Stablecoin/CBDC World

As governments and central banks push forward with CBDCs (central bank digital currencies) and stablecoin regulation, many of the open rails we take for granted today may become gated, monitored, or outright restricted.

In that world, Bitcoin plays a different role—not the everyday money, but the exit door. The fallback. The last protocol standing when others are co-opted.

From Use to Security

Each of these use cases creates real, fee-paying demand. Not driven by hype. Not by speculation. But by need. And that demand is what keeps Bitcoin alive when the last BTC is minted.

In these moments, block space becomes a lifeline.

And paying a fee isn’t a cost—it’s a vote for freedom.

From Counterculture to Corner Office

While some turn to Bitcoin for survival, others now turn to it for yield, exposure, and portfolio balance.

The arrival of Bitcoin ETFs and ETPs—especially in the U.S.—marks a cultural tipping point:

BlackRock, Fidelity, and other giants now offer regulated Bitcoin access to retail and institutional investors.

Billions in inflows validate BTC as an asset class.

Bitcoin is no longer fringe—it’s financial infrastructure.

Alongside this, regulatory frameworks like the Lummis-Gillibrand Act and other global efforts are bringing clarity to Bitcoin’s legal and economic status. We may soon see legislation that treats Bitcoin as:

A commodity, not a security. What’s the difference?

A security (like a share in a company) implies that there’s a central entity promising returns or managing investor expectations.

A commodity (like gold or oil) is a raw asset that holds value and can be exchanged, but doesn’t depend on a third party.

A protected activity (for mining, custody, and peer-to-peer use)

A strategic national infrastructure in the digital economy

These developments don’t erase Bitcoin’s origin story. They expand it.

Bitcoin is no longer just rebellion. It’s institutional and insurgent at once.

5. The 2140 Scenarios: Bitcoin’s Post-Issuance Futures

By 2140, all 21 million bitcoins will have been mined. No more block subsidies. No more new coins entering circulation. The monetary faucet turns off—and the network must survive on fees alone.

So, what happens then?

No one knows exactly. But we can explore the most plausible futures based on today’s incentives, trends, and tensions. Here are the four major scenarios:

Scenario A: The Fee Market Matures

In this best-case scenario, Bitcoin successfully transitions to a fee-only security model. Block space is in high demand—because of real use cases, second-layer activity, institutional settlement, or geopolitical relevance. Fees become predictable and sufficient to support high hashrate mining.

In this world:

Miners are still profitable.

Users are still willing to pay.

Security remains decentralized and robust.

Think of this as Bitcoin growing into its final form: a high-assurance base layer, powered by belief and economic gravity.

Scenario B: The Security Crunch

In this darker scenario, fees fail to keep up with the cost of mining. Demand is too low, or block space competition has moved elsewhere. Hashrate drops. Security weakens.

Possible consequences:

Fewer miners → slower blocks or higher orphan rates.

Lower hashrate → cheaper 51% attacks or censorship attempts.

Centralization → mining becomes the domain of state-backed actors or a handful of players.

In this world, Bitcoin may still exist—but in a fragile state. Not dead. But vulnerable.

Scenario C: Protocol Change

If the network faces a serious security cliff, some will propose changes to Bitcoin’s monetary policy. The most likely? A “tail emission”—a small, perpetual issuance (say, 0.1% annually) to continue rewarding miners.

Supporters argue this is pragmatic:

→ Modest inflation in exchange for long-term security.

Detractors call it heresy:

→ Bitcoin promised 21M. Changing that breaks the most sacred part of the social contract.

If this debate ever happens, it could split the network, both technically and philosophically.

Scenario D: Layer 2 Dominance

In this path, Bitcoin becomes a high-security settlement layer, while most everyday activity moves to Layer 2s like the Lightning Network, rollups, or future sidechains.

Mainchain fees stay high—but usage shifts:

Few high-value transactions are settled on L1.

Most payments, microtransactions, and dApps operate on L2s.

Users still pay fees indirectly—just routed through different channels.

Bitcoin becomes like TCP/IP: mostly invisible, deeply critical.

The chain survives not by volume, but by economic density.

🃏 Wildcards and External Shocks

There are also wildcard variables that could push Bitcoin into new, unpredictable territory, outside the bounds of its original script. These aren’t bugs in the protocol; they’re pressures from the real world, unpredictable and deeply consequential.

Nation-state mining cartels or central bank reserves in BTC

Take, for example, the creeping involvement of nation-states. El Salvador already holds bitcoin in treasury, and has built national infrastructure around it. The U.S. government—somewhat ironically—has become one of the largest holders of BTC due to criminal seizures, holding hundreds of thousands of coins. Meanwhile, there are quiet whispers about Russia and other sanctioned regimes mining Bitcoin as a geopolitical hedge. If central banks or governments begin hoarding BTC or dominating mining, the network could shift from a neutral protocol to a contested strategic resource, not unlike oil or gold. That raises uncomfortable questions: Can a tool meant to decentralize power survive once it becomes part of state power?

Global energy re-pricing that changes mining economics

Energy is another wild variable. Bitcoin’s security depends on miners—who depend on cheap energy. Right now, places like Texas, Paraguay, and Kazakhstan offer havens of low-cost electricity, but that could change quickly. Global repricing due to climate policy, war, or technological breakthroughs could either supercharge Bitcoin’s security or suddenly starve it. In a world chasing renewables and energy efficiency, will Bitcoin be welcomed as a flexible load that stabilizes grids—or targeted as a villain when blackouts come?

Quantum computing breakthroughs or cryptographic challenges

Then there’s the specter of quantum computing. Still hypothetical, but no longer the realm of science fiction. If quantum machines become powerful enough to break the cryptography underpinning Bitcoin’s signatures, old wallets could be drained, and trust in the system shaken. The Bitcoin developer community has begun to discuss contingency plans—post-quantum cryptographic upgrades exist—but they’re complex and would require wide consensus to implement. It’s one thing to secure a blockchain against malicious miners. It’s another to future-proof it against physics.

Cultural shifts that either revitalize or abandon the project

But perhaps the most fragile wildcard is culture. Bitcoin runs on belief as much as code. It started as a cypherpunk rebellion, then evolved into a financial hedge, a political statement, a store of value. Lately, it’s become a playground for Ordinals, meme collectors, and NFT-style inscriptions—alienating some purists but drawing in a new crowd. That cultural multidimentional tug-of-war matters. If people stop believing in Bitcoin—not just as money, but as a movement—usage could dry up, fees could shrink, and the network could hollow out. Or, perhaps the opposite happens: new communities, new use cases, and new philosophies could breathe life into Bitcoin beyond its original mythology.

In the end, none of these variables are in the whitepaper. But they may be just as important. Because the question of whether Bitcoin survives after 2140 won’t be answered by code alone—it’ll be answered by geopolitics, energy flows, quantum breakthroughs, and human belief.

6. Conclusion: Building Bitcoin’s Final Form

The last satoshi will be mined around the year 2140. You won’t be here. Neither will I.

But the question isn't really about that final moment.

It's about what we build—now—to make sure Bitcoin still matters then.

Because Bitcoin is not a finished product. It’s a living protocol, a cultural experiment, and a monetary rebellion all at once. Its future hinges not just on code or capital—but on conviction.

Bitcoin’s bootstrapped security model is a bet on human behavior. A bet that people will find enough value in the network to keep using it, keep paying for it, and keep defending it—even when no new coins are left to mint.

That’s what makes 2140 not an endpoint but a stress test.

By the time we get there, Bitcoin must be:

Economically resilient with a thriving fee market

Culturally indispensable worth defending across generations

Geopolitically relevant an escape hatch, a hedge, a neutral rail

Technically lean and secure able to function as a foundational layer for a modular financial future

All of that starts today.

The apps we build, the stories we tell, the education we spread, the myths we protect—all of it contributes to whether Bitcoin survives long after the mint runs dry.

So no, 2140 isn't the end of Bitcoin. It’s the moment it either stands on its own—or quietly fades into history.

What Can Shape Bitcoin’s Fate in 2140?

🧮 Economic Variables

Transaction fee demand — Will users pay enough to keep miners incentivized?

Hashrate and energy markets — Will mining remain economically viable as subsidies end?

Bitcoin price — Will the asset retain enough value to justify continued investment in security?

L2 and off-chain activity — Will economic activity migrate too far from L1 to sustain it?

🔐 Technical Variables

Scalability of the base layer — Can Bitcoin continue to process high-value transactions efficiently?

Mempool congestion and fee dynamics — Will the fee market function smoothly without subsidies?

Cryptographic resilience — Will Bitcoin remain secure in a post-quantum world?

Interoperability — Will Bitcoin integrate with emerging financial and technological systems?

🌐 Geopolitical Variables

Regulatory clarity or suppression — Will Bitcoin be embraced, tolerated, or banned?

Sovereign adoption — Will more countries follow El Salvador, or retreat from BTC integration?

Currency crises and capital controls — Will people increasingly need Bitcoin as a lifeline?

🎭 Cultural & Social Variables

Memetic power — Will Bitcoin remain emotionally resonant across generations?

Narrative dominance — Will it continue to be seen as “digital gold,” or replaced by a better story?

Community governance and stewardship — Will its culture remain antifragile or calcify?

Developer and builder energy — Will people still want to build on or around Bitcoin?

🧠 Philosophical Variables

Trust in fixed supply — Will the 21M cap be preserved, or face pressure to change?

Relevance of decentralization — Will people still care about censorship resistance in a highly surveilled world?

Ethics of issuance — Will a future Bitcoin community choose tail emissions or strict purity?

Bitcoin's survival in 2140 won’t depend on one factor—it’ll depend on the interplay of belief, behavior, utility, and culture.

It’s a social contract with economic consequences.

The last satoshi will be mined around 2140.

But the real question is: Will Bitcoin still matter?

That answer depends on what we do now.

Bitcoin isn’t a finished product. It’s a living system. A cultural artifact. A protocol shaped by people, purpose, and participation.

Bitcoin was born out of unconformity—out of a global exhaustion with broken monetary policies, centralized bailouts, and extractive institutions. It’s not a quick fix. It’s a legacy project. One that will take decades—maybe generations—to build, normalize, and anchor.

And even though we can't predict the future, using this technology, teaching it, building with it, and contributing to its story is how we learn to walk in a new paradigm. One that doesn’t just shift economic mechanics—but reshapes global social structures, values, and belief systems.

We’re not just mining blocks. If we choose to live in the longer now, we’re not waiting for 2140, we’re building toward it. We’re engineering trust at scale laying the scaffolding for the next civilization.